6 cost forecasting techniques in EVM (EAC/ETC)

Do you feel your budgeting process has failed from the start of your project? Have you learned that you overbudgeted or underbudgeted the activities in your performance measurement baseline (PMB)? Are you willing to take your Earned Value Analysis (EVA) to the next level? Then this is a blog post for you.

As you’ve read and understood in the previous blogpost about Earned Value Management, it primarily says something about the past. It’s time to look at the future; EVM has a set of performance indicators that grant the option to forecast the cost at completion. Earned Value Management has a metric for this called the Estimate At Completion (EAC). Many people using simple EVM think that there is a one-fits-all formula to calculate EAC. But there, is not. In this blog post we will point out 6 different methods, along with some advice on when to pick which method, for calculating EAC accurately in your project.

Introduction of the Estimate To Complete (ETC) and Estimate At Completion (EAC)

To grant insights on the monetary outcome of your project, you’ll want to re-evaluate Estimate at Completion. This embodies the total amount of money that the project will have cost at project closure. Because the project progresses through time, we split the EAC in the actual cost (AC) to date and the remainder of the project’s estimated cost. Earned Value Management named this the Estimate To Complete (ETC).EVM wouldn’t be a great system to evaluate your performance and project it into the future if it didn’t provide a handful of techniques to valuate this ETC. In the following paragraphs, we’ll stipulate them by a guiding example.

Example project

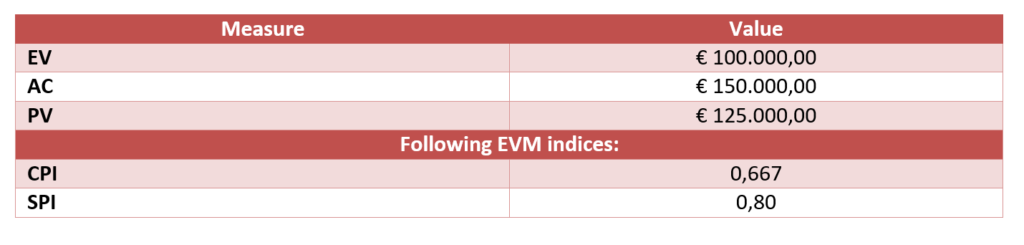

Let’s imagine a Control Account with a € 200.000,00 Budget at Completion. Some periods through the project, the following characteristics apply:

(If you think I’m going to fast here, please read my other blog about the basics of EVM first)

You are asked to make an Estimate At Completion using every method underneath.

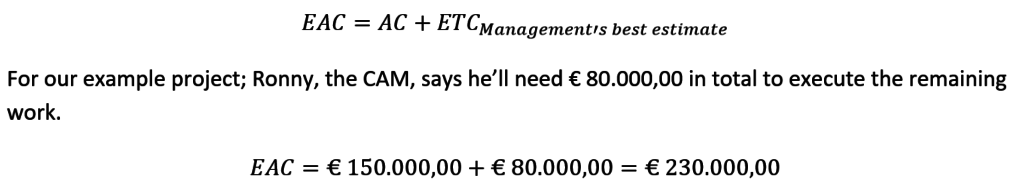

1. Management Estimate

The Management Estimate is the first and most commonly used estimation method, also known as the expert opinion. For internal projects, this can be easily applied and embodies a very accurate approach when punctually executed. The responsible CAM estimates the remaining work (ETC), bottom-up, and adds this up to the Actual Cost to date. He’s keeping in mind revised direct and overhead rates, material cost, contract amendments etc. The problem of this approach might be that the ETC is calculated based on (wishful) estimates rather than on factual data. Project managers could easily hide bad performance, which is completely against the spirit of EVM.

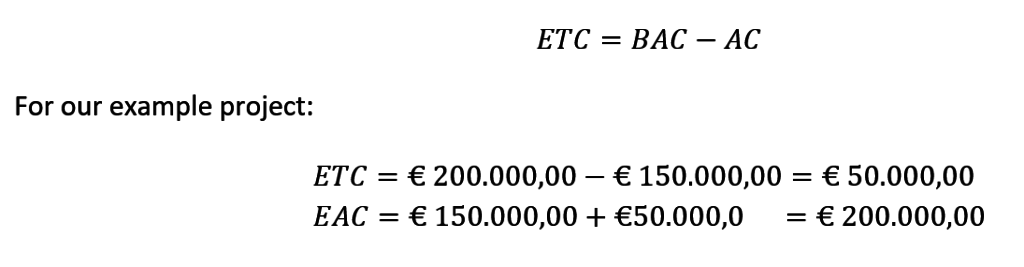

2. Budget at Completion (BAC) remains our best estimate

In this case we realize the variance so far is a reality. Nonetheless, the CAM estimates the project will finish on budget. The formula underneath will become superfluous because the EAC equals the BAC.

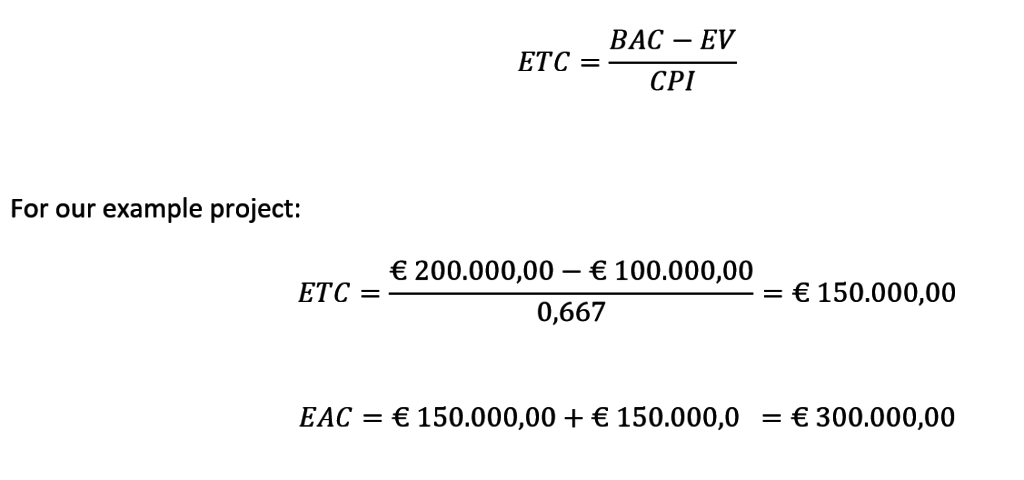

3. Current variance is typical for the work to come

When we expect the measured performance to be typical to the project or work package, we extrapolate this performance to the work to come. By doing this, we estimate the remaining work to be executed at the same Cost Performance Index (CPI) as the actual work performed.

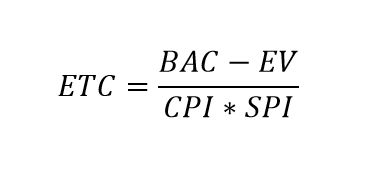

4. Acceleration of remaining work

When the project is behind of (or ahead of) schedule and we aim to reach the ultimate project deadline with extra (or less) resources to reach this deadline, we incorporate the SPI into the ETC. This results in a formula that estimates the extra cost of the remaining accelerated work in the ETC. The formula underneath applies:

Our example project has an SPI of 0,80 and is thus behind of schedule. We could increase the amount of resources used to complete the remaining work.

For our example project:

The remaining cost is now raised compared to the previous example. The addition of resources influences the efficiency of the remaining work. We could state that this estimate has more nuance in it.

The remaining cost is now raised compared to the previous example. The addition of resources influences the efficiency of the remaining work. We could state that this estimate has more nuance in it.

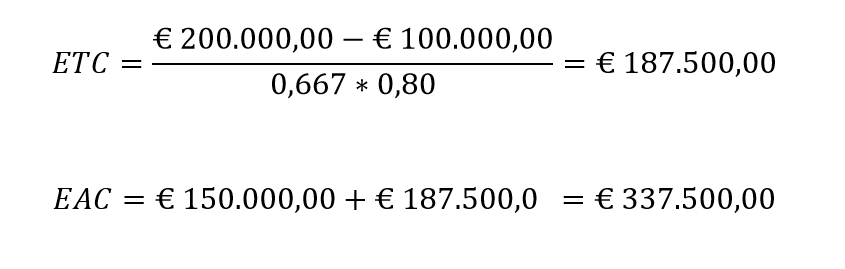

5. Variance is not recurring

When the Control Account Manager (CAM) knows the variance cannot be recurring, for example, when the future type of work is totally different from the work performed, or a major issue has occurred, he/she can decide not to extrapolate the positive or negative variance. The CAM believes the budget of the remaining work, which was estimated at the project start, remains feasible. The basic formula for the budgeted cost for remaining work applies:

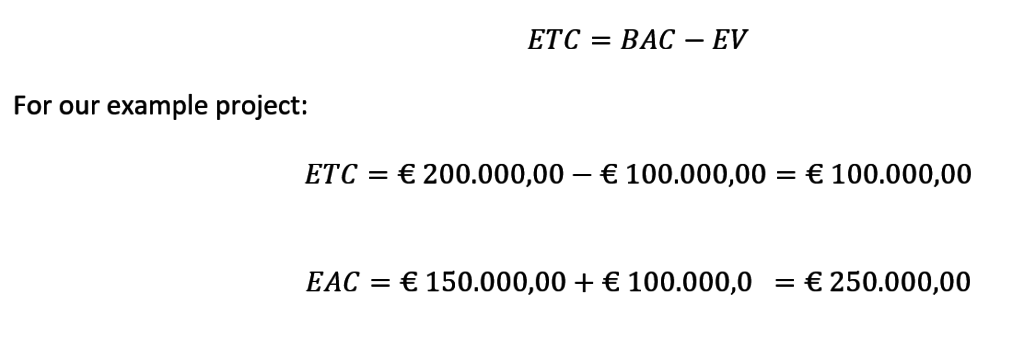

6. Keeping Fixed price parts Fixed

6. Keeping Fixed price parts Fixed

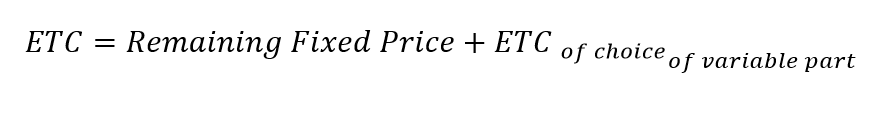

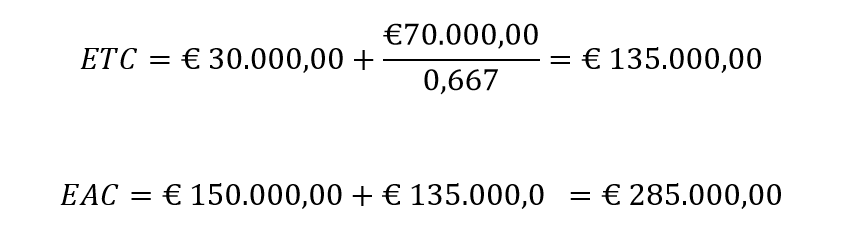

As a general best practice, we keep the part of the project which is fixed price (subcontracts f.e.) as a constant budget to keep it realistic. This method is easily applied when using the right tools to plan the cost of the project. By coding the costs in a logical manner and applying good contract management to the project, we can filter and extrapolate only parts of the budget.

For our example project, we made a make or buy decision and outsourced a part of the work. The BAC for this part was € 30.000,00 and will be executed at the same price. The contract is fixed price. We keep this fixed price subcontract in mind, extrapolating past performance using the CPI:

Conclusion

If we want EVM to create optimum value for our project, there is no one-fits-all formula to calculate EAC. To communicate an accurate EAC to the stakeholders, you need a good insight in the cost centers, a feel of the field and knowledge of the occurred issues. It’s not only a matter of gut feeling, but also the right tools and a competent, project cost controls unit that’s well-informed on the business drivers behind the financial numbers, play a major part. The list of methods and situations in this blog post is not exhaustive. Good old-fashioned common sense will grant you extra possibilities and techniques to approach the EAC better to the actual cost at completion.

Inform us on your thoughts and techniques in the comment section below and stay tuned for more on Earned Value Management and other project controls knowledge areas.

This blog is originally placed on Primaned.be op 20 December 2017.