A budget is not the same as a cash flow

As a follow-up to the post about the difference between a time buffer and total float; here is a new post in the same series – seemingly easy concepts that seem to confuse many. This one might be an open door for financial or general management profiles, but it is not for most project controls engineers.

Project cost controls

Let’s start by telling that project cost controls is not the same as project financial control. In many manufacturing environments both can be seen as synonyms, but not at all in large projects.

A financial controller focuses on the outputs from past actions. Invoicing, exchange rates, cash flows, funding, etc. are typical concerns of these financial profiles. You clearly need them on every project. Ideally, they are members of the finance department that are assigned to one or more projects. They are the financial conscience of the project that add value because they think differently than most technical project team members.

On the other hand, project cost controls is a core project management function. The aim of project cost controls is to deliver insight in the budgetary performance of the project, to analyze the underlying business drivers and to recommend actions to improve the forecast. Thus, a cost engineer is a project engineer and must understand the ins and outs of the underlying business. Accountants are probably not the right profile for this. We are advocates to integrate this function together with scope control, scheduling and risk analysis into a comprehensive project controls function that reports to project management, not to the finance department.

S-curves

Most project cost controls techniques heavily rely on S-curves. Earned Value Management as explained in depth by my colleague Niels Ligtvoet, is a prime example. In this blog post you can see how Earned Value Management tackles a typical fallacy in financial project control. EVM is quite convincing in showing why project cost controls is required.

But how do we make an S-curve? Here understanding the difference between a cash flow forecast and a budget is vital. An S-curve or a planned curve is essentially a baselined time-distributed project budget. Indeed, not a cash flow prediction.

The budget

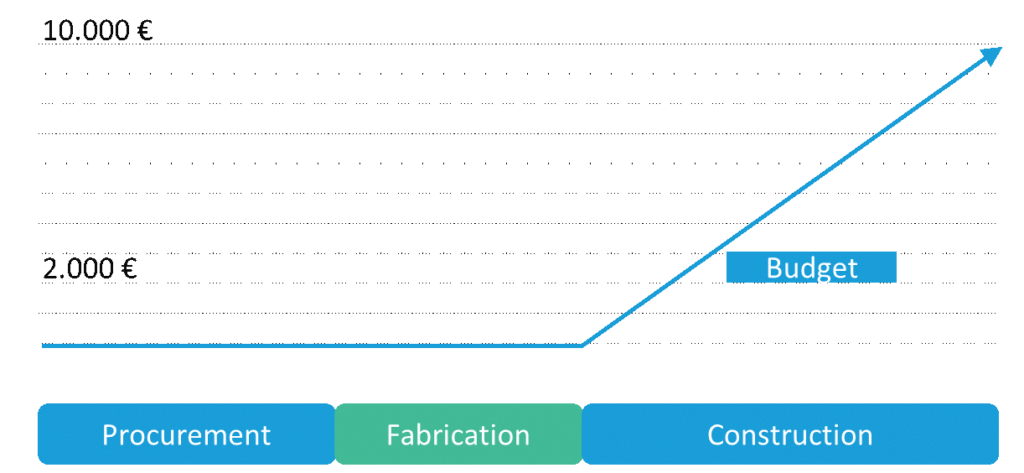

A budget is a plan that distributes the authorised resources over time periods and work packages. It is intended to reserve resources, to steer the execution, and more importantly as a baseline to control performance. A key insight here is that it only exists as a (computer) model, no physical money is involved. In a budget work is planned in the time periods that it is executed, not when it is invoiced or when it is on your bank account.

Here is the typical remark we receive when people don’t have it right:

Yes, but my subcontractor is paid with a 10% upfront payment.

Let me be clear on this: when we are budgeting, physical money flows (or indeed, cash flows) don’t matter. Allow me to use an example. Consider that a machine is required for 10 days during construction and that it costs 10.000 €. 20% has to be paid when the Purchase Order is signed and the rest at the start of the works. How does the budget look?

Did you have that right? The machine is budgeted when it is being used, so during construction in this case. When the machine is paid is redundant information for budgeting purposes.

Cash Flows

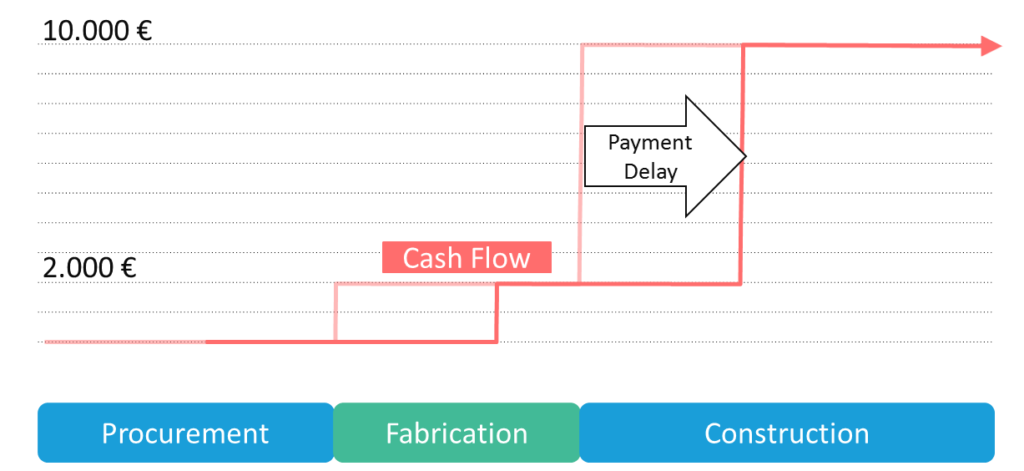

A cash flow is the amount of money being transferred into and out of the project. It is intended to analyze the liquidity position of the project. Predicting cash flows are related to actual payments and should even take payment delays and currency fluctuations into account. It is mainly a project finance thing, but project controls is involved. More precisely, cash flows in projects heavily rely on payment milestones and those are of course included in the schedule by project controls. It is even their job to monitor these milestones and to propose actions to improve the cash flow position.

In our example, the cash flow prediction might look as follows:

Cost control

During execution, actual costs will be recorded and compared to both budget and cash flow prediction, but for a different reason. What is more important is that the way actuals are calculated is also quite different. What to do with accruals (completed, but not invoiced), commitments (purchased, but not completed) or deferrals (invoiced, but not completed)? The answer is not the same when you are controlling the budget or the cash flow. But let’s keep that for a later blog post.

Conclusion

Many of our clients have a high interest in Earned Value Management as a technique to better monitor their project costs. However, they often struggle to create the correct planned value curves. In this blog we tried to clarify this. Any comment is very welcome!

This blog is originally placed on Primaned.be op 23 May.